-

Posts

3,840 -

Joined

-

Last visited

-

Days Won

119

richardmurray's Achievements

Single Status Update

See all updates by richardmurray

-

Why there's a 'high bar' for new EV tax credits, according to a Biden economic adviser

Akiko Fujita

Akiko Fujita·Anchor/Reporter

Thu, August 18, 2022 at 9:16 AMThe White House’s top economic adviser defended restrictions placed on the Inflation Reduction Act (IRA)’s key tax credits that are intended to accelerate electric vehicle (EV) adoption.

Under the new bill President Joe Biden signed into law on Monday, drivers are eligible for a $7,500 tax credit for new EVs or $4,000 for used vehicles largely sourced and manufactured in the U.S.

However, critics — including some carmakers — have criticized the administration for limitations placed, saying it’s likely to slow down the adoption of EVs and leave drivers with few options.

“Certainly, it sets a high bar that that tax credit is eligible for batteries and vehicles that are produced in the United States or in North America or countries that we have free trade agreements with,” Brian Deese, director of the National Economic Council, told Yahoo Finance Live (video above). “We think that that's an appropriate bar because what we want across time is to provide a strong incentive for us to have secure supply chains in those areas.”

Specifically, the new law restricts the full tax credit to EVs with battery material sourced from the U.S. or free-trade partners, starting in 2024. Any minerals or components sourced from “foreign entities of concern” including China would not qualify for the $7,500 credit. Final assembly of the vehicle would also need to take place in North America.

Adding to the restrictions, the law only applies to vehicles with a manufacturer suggested retail price (MSRP) below $55,000 for cars and below $80,000 for trucks and SUVs.

A necessary step

Biden has hailed the hundreds of billions of dollars committed to tackling climate change through the IRA as “one of the most significant laws in recent history,” but carmakers have criticized the new legislation for attaching too many strings and limiting the wide-scale adoption of clean cars.In a recent interview with Yahoo Finance Live, Fisker CEO Henrik Fisker called the restrictions counterproductive, arguing that the limitations would actually “slow the adoption of EVs.”

“It's going to offer less choice to the consumers," he said. "I'll be surprised if there's even 10 vehicles in the US that will qualify for the full amount."

An analysis by the Congressional Budget Office estimated the $85 million set aside for new EV credits in the 2023 fiscal years would only translate to 11,000 new vehicles sold under the $7,500 credit. That pales in comparison to roughly 630,000 EVs sold in 2021 just in the U.S.

Deese said the “high bar” is a necessary step to entice carmakers into investing in supply chains closer to home. An overwhelming majority of minerals and components used in vehicles today are currently sourced from China.

Specifically, the new law restricts the full tax credit to EVs with battery material sourced from the U.S. or free-trade partners, starting in 2024. Any minerals or components sourced from “foreign entities of concern” including China would not qualify for the $7,500 credit. Final assembly of the vehicle would also need to take place in North America.

Adding to the restrictions, the law only applies to vehicles with a manufacturer suggested retail price (MSRP) below $55,000 for cars and below $80,000 for trucks and SUVs.

A necessary step

Biden has hailed the hundreds of billions of dollars committed to tackling climate change through the IRA as “one of the most significant laws in recent history,” but carmakers have criticized the new legislation for attaching too many strings and limiting the wide-scale adoption of clean cars.In a recent interview with Yahoo Finance Live, Fisker CEO Henrik Fisker called the restrictions counterproductive, arguing that the limitations would actually “slow the adoption of EVs.”

“It's going to offer less choice to the consumers," he said. "I'll be surprised if there's even 10 vehicles in the US that will qualify for the full amount."

An analysis by the Congressional Budget Office estimated the $85 million set aside for new EV credits in the 2023 fiscal years would only translate to 11,000 new vehicles sold under the $7,500 credit. That pales in comparison to roughly 630,000 EVs sold in 2021 just in the U.S.

Deese said the “high bar” is a necessary step to entice carmakers into investing in supply chains closer to home. An overwhelming majority of minerals and components used in vehicles today are currently sourced from China.

“The core of this bill on the clean energy side is to provide long-term technology-neutral tax credits so that we generate lower carbon energy here in the United States and we generate the technology and the technological advances that come with that,” he said. “We certainly expect that because of this legislation, companies and the suppliers in the supply chain are going to respond quite significantly.”

Companies like General Motors (GM) have already responded by seeking out minerals sourced in the U.S, and investing in mining operations in places like California. But the timeline for completion of those projects still remain years away.

The Alliance for Automotive Innovation — a trade group that counts Toyota (TM), Ford (F), and GM among its members — estimated that 70% of the 72 EV models currently sold on the market will be ineligible for the new car tax credits because of the restrictions.

In the immediate term, Deese said, the $4,000 tax credit for used cars would likely accelerate adoption, given that the same limitations do not apply.

“Most Americans who are out there buying vehicles are actually buying used cars, particularly lower working class folks,” he said. “So we have more electric vehicles in our vehicle mix. Having a credit for used vehicles is incredibly powerful. It helps broaden the number of Americans who could see themselves getting into an electric vehicle."

Akiko Fujita is an anchor and reporter for Yahoo Finance. Follow her on Twitter @AkikoFujita

What's In the Inflation Reduction Act?

JUL 28, 2022

Update (8/11/2022): The Senate passed an amended version of the Inflation Reduction Act on August 7, which included several changes to the bill's tax and prescription drug provisions. While the Congressional Budget Office (CBO) has indicated a full score of the amended bill will be published in the coming weeks, the Joint Committee on Taxation has released an updated score of revenue provisions in the bill, showing the new version would raise an additional $22 billion in revenue. However, we anticipate the prescription drug savings provisions will now save less than the $322 billion in the previous version. We will update this analysis once CBO releases its full score of the bill.

The Congressional Budget Office (CBO) just released its score of the Inflation Reduction Act (IRA) of 2022, legislation which would use Fiscal Year (FY) 2022 reconciliation instructions to raise revenue; lower prescription drug costs; fund new energy, climate, and health care provisions; and reduce budget deficits.

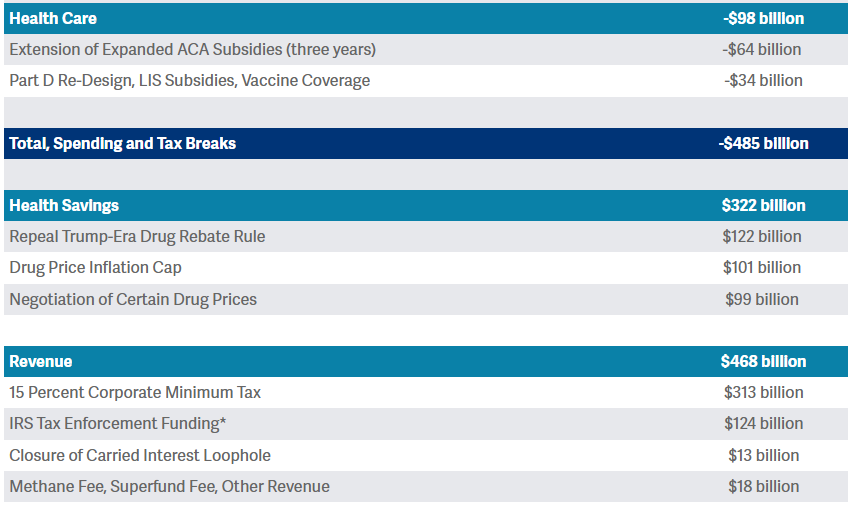

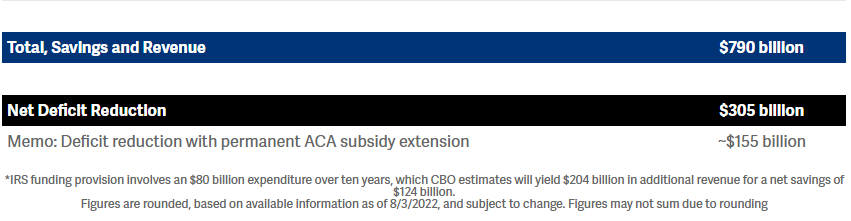

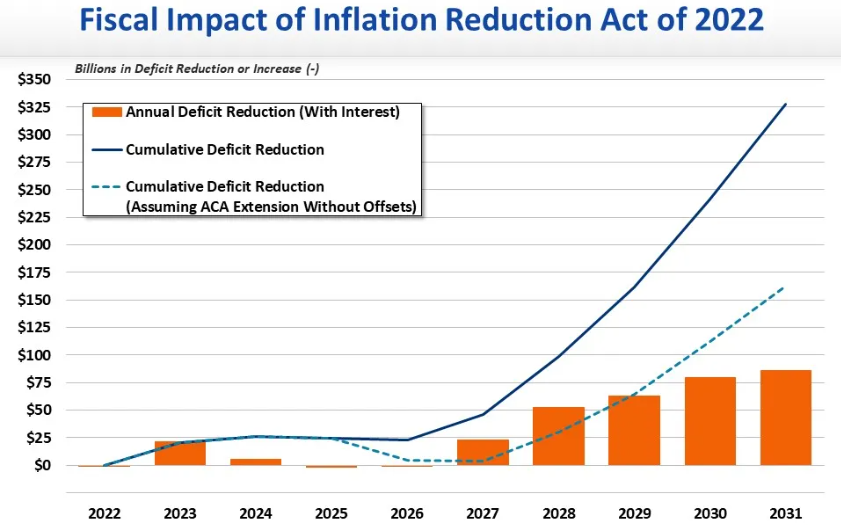

Based on the CBO score, the legislation would reduce deficits by $305 billion through 2031 – including over $100 billion of net scoreable savings and another $200 billion of gross revenue from stronger tax compliance.

Because the prescription drug savings would be larger than new spending, CBO finds the legislation would modestly reduce net spending by almost $15 billion through 2031, including by nearly $40 billion in 2031.

Once fully phased in, the plan would also slightly cut net taxes by about $2 billion per year – with expanded energy and climate tax credits roughly matching the size of new tax increases. The legislation would generate nearly $300 billion of net revenue over a decade, mostly from improved tax compliance and the spillover effects of higher wages as a result of lower health premiums -- neither of which are tax increases -- along with early revenue collection as corporations shift the timing of certain payments.

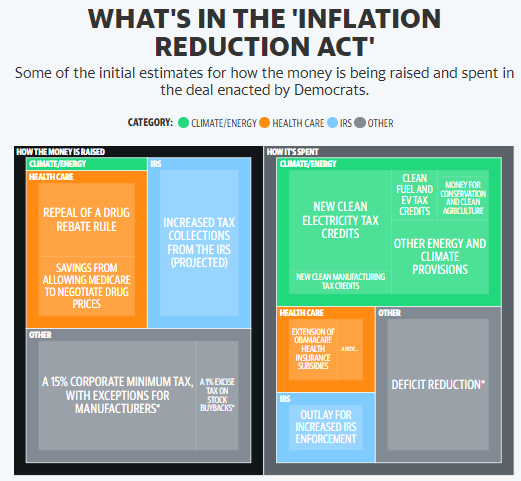

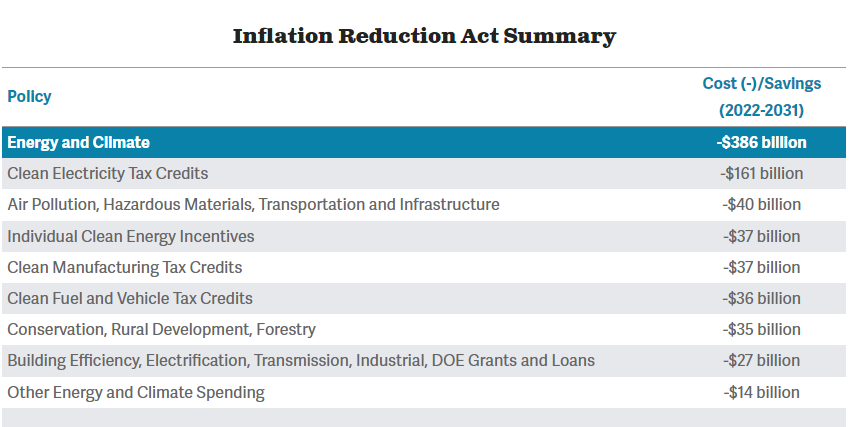

Overall, CBO estimates the legislation includes $790 billion of offsets to fund roughly $485 billion of new spending and tax breaks (as negotiators account for the policies, it includes $739 billion of offsets and $433 billion of investments). Unlike prior versions of this reconciliation bill, such as the House-passed Build Back Better Act, this legislation would reduce deficits. Along with other elements of the bill, it is likely to reduce inflationary pressures and thus reduce the risk of a possible recession.

The package includes $386 billion of climate and energy spending and tax breaks – mainly for new or expanded tax credits to promote clean energy generation, electrification, green technology retrofits for homes and buildings, greater use of clean fuels, environmental conservation, and wider adoption of electric vehicles, among other purposes. The package would also increase health care spending by nearly $100 billion, mainly by extending the American Rescue Plan's temporarily-expanded Affordable Care Act (ACA) premium tax credits for an additional three years, through 2025. Accompanying this new spending would be various regulatory and permitting reforms to help reduce energy costs outside of the reconciliation package.

The $485 billion of new costs would be offset with $790 billion of additional revenue and savings over a decade. This includes roughly $313 billion from imposing a 15 percent minimum tax on corporate book income; $322 billion for various reforms to reduce prescription drug costs; $124 billion ($204 billion gross) from reducing the tax gap through stronger Internal Revenue Service (IRS) enforcement; $13 billion from closing the carried interest loophole; and $18 billion from fees on methane emissions, Superfund cleanup sites, and a permanent extension of the higher tax rate for the Black Lung Disability Trust Fund.

The legislation would reduce deficits by over $20 billion in the first year, and – with interest – over $85 billion in 2031. We recently estimated it would reduce debt by nearly $2 trillion over two decades. Assuming the permanent unpaid-for extension of ACA subsidies (which we would strongly oppose), the plan would likely save almost $50 billion per year by 2031.

Although reconciliation was designed for deficit reduction, this would be the first time in many years it was actually used for this purpose. It would also be the largest deficit reduction bill since the Budget Control Act of 2011. With inflation at a 40-year high and debt approaching record levels, this would be a welcomed improvement from the status quo.WEBPAGE

https://www.crfb.org/blogs/whats-inflation-reduction-act

.thumb.jpg.ed52910791d00308abb8c218695bec88.jpg)